Boosting Agility in American Fintech with Distributed Next.js

In the fast-paced world of financial technology, speed, security, and regulatory compliance are no longer optional—they are essential for survival and growth. U.S. fintech companies must deliver real-time transactions, secure user experiences, and scalable applications to meet ever-evolving customer expectations and compete in an increasingly digital marketplace.

CloudActive Labs empowers fintech organizations by providing dedicated distributed Next.js development teams, enabling rapid deployment, seamless compliance, and enhanced operational efficiency across their digital platforms.

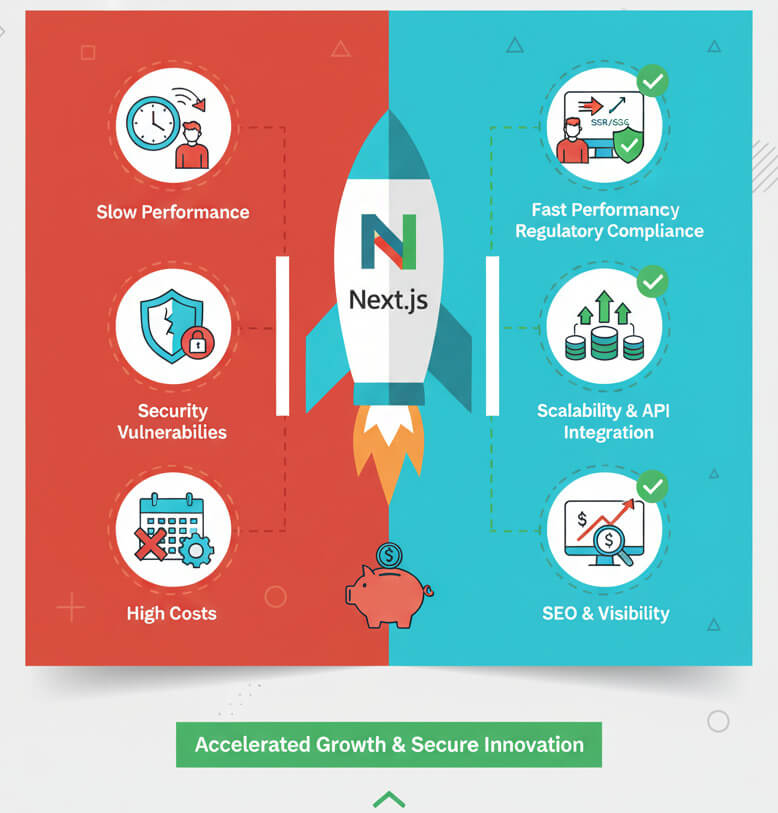

Why Next.js is a Game-Changer for Fintech

Next.js is increasingly adopted by fintech companies due to its ability to combine performance, scalability, and security:

- Server-Side Rendering (SSR) and Static Site Generation (SSG): Ensures applications load quickly and reliably, critical for banking dashboards, investment platforms, and transaction portals.

- High Scalability: Capable of handling large numbers of concurrent users, high transaction volumes, and complex workflows without performance degradation.

- Advanced Security Features: Supports secure authentication, encryption, and API integrations, helping fintech applications remain compliant with HIPAA, GDPR, and financial regulations.

- SEO and Performance Optimization: Ensures that digital platforms remain visible, fast, and responsive, even under heavy user load.

By leveraging these features, fintech organizations can accelerate innovation, reduce downtime, and deliver exceptional customer experiences.

Key Challenges U.S. Fintech Firms Face

Despite the advantages of Next.js, fintech companies in the U.S. encounter significant obstacles when building and scaling applications:

Regulatory Compliance: Navigating complex regulations such as SEC, FINRA, and GDPR requires careful attention to development practices and data handling.

- Data Security: Protecting sensitive financial data from cyber threats is critical to maintaining trust and avoiding penalties.

- Talent Shortages: Finding skilled JavaScript and Next.js developers locally is expensive and competitive, slowing down product development.

- Time-to-Market Pressure: Financial applications often need rapid feature releases to stay ahead of competitors and meet market demand.

Operational Costs: Onsite teams come with significant overhead, including salaries, benefits, and office infrastructure.

How Distributed Next.js Teams Boost Fintech Agility

CloudActive Labs’ distributed Next.js teams offer a solution to these challenges by combining technical expertise, cost efficiency, and operational flexibility:

- Specialized Technical Expertise

Developers with deep experience in Next.js, Node.js, microservices architecture, and secure API integrations ensure that fintech platforms are robust, scalable, and high-performing.

- Regulatory Compliance and Security

Our teams implement industry best practices, including encryption, secure authentication, and compliance protocols, ensuring applications meet stringent regulatory standards.

- Rapid Iteration and Deployment

Agile workflows allow for continuous development, testing, and deployment, enabling fintech firms to respond quickly to market changes, new regulations, or customer demands.

- Flexible Scalability

Distributed teams can scale up to handle high transaction loads, seasonal spikes, or expanded product offerings, all without the need for additional office space or overhead.

- Cost-Effective Innovation

Remote development reduces the high cost of hiring locally while providing access to top-tier global talent, making fintech projects more budget-friendly without compromising quality.

- Seamless Collaboration

Using modern tools such as Slack, Jira, and GitHub, distributed teams integrate smoothly with internal departments, ensuring transparent communication, consistent progress tracking, and aligned objectives.

Tangible Benefits for U.S. Fintech Companies

By leveraging distributed Next.js teams, fintech firms gain multiple advantages:

- Accelerated Time-to-Market: Faster feature releases and updates enable firms to stay ahead of competitors.

- Enhanced Security and Compliance: Risk of breaches and regulatory penalties is minimized through secure development practices.

- Operational Flexibility: Teams can adapt to shifting project priorities or sudden growth without disruptions.

- Access to Global Expertise: Specialized developers bring the latest industry knowledge and best practices to every project.

- Budget Efficiency: Significant cost savings compared to onsite teams, freeing capital for other strategic initiatives.

These benefits collectively enhance agility, reliability, and competitiveness, allowing fintech organizations to focus on growth and innovation.

Conclusion

In the modern U.S. fintech landscape, agility, security, and regulatory compliance are essential. Distributed Next.js development teams from CloudActive Labs provide a strategic, cost-effective solution that empowers financial technology companies to deliver high-performance, secure, and scalable applications.

With dedicated remote experts, fintech firms can accelerate product development, reduce operational overhead, and ensure compliance, while maintaining flexibility to scale with market demands.

Ready to boost your fintech agility with distributed Next.js teams?

Contact us: [email protected]

Visit: www.cloudactivelabs.com